Accounting statements are crucial to the operation of a business. It’s important to always have a good idea of how your business finances are doing, especially when you are starting out as a small business owner.

Something as simple as reviewing your income, expenses, or cash flow statement could give you a better idea of the steps you need to take in order to move your business forward. In the commercial world, there are 5 reports that are crucial.

These are Income Statement, Balance Sheet, Statement of Changes in Owner’s Equity, Cash Flow Statement, and Accounting Receivables Aging Report.

Nevertheless, only some of those or related reports are covered in the GCE N- and O-Level POA Syllabus. The fundamental understanding of the following accounting statements covered in the syllabus would enable students, like you, to master the basic skills to appreciate and analyse the reports.

-

Table of Contents

Income Statement

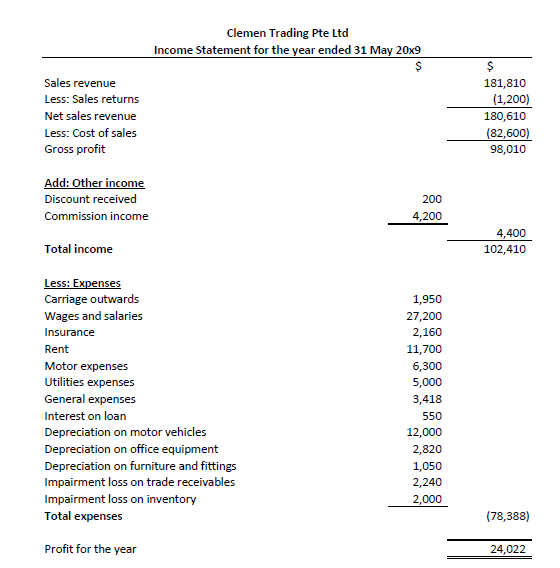

The income statement’s primary purpose is to show the financial performance of a business. The amount of profit or loss that a business makes during a certain period is the key indicator of its financial performance.

Different types of businesses will use different forms of an income statement. For instance, service businesses, which refers to medical, accounting, legal practices, or even a cleaning service, use what is called a Single-Step Income Statement which records only one category of income and expenses.

Trading and manufacturing businesses use a different form of an income statement which is known as a Multi-Step Income Statement which uses multiple subtractions to calculate the net income shown on the bottom line. In fact, this syllabus uses the Multi-Step Income Statement.

The example above shows the income statement of a general trading business which made up of a trading section (to obtain gross profit) and a profit & loss section (to obtain profit or loss for the period).

-

Balance Sheet

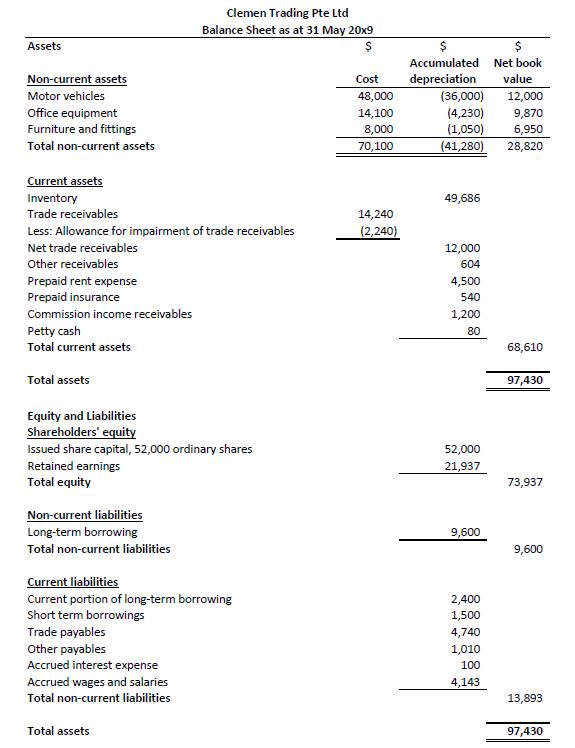

A Balance Sheet is basically an accounting statement that shows you what a company owns (assets) and owes (liabilities), as well as the amount invested by shareholders (equity). It showcases the financial position of a business on a particular day.

It is used together with other important accounting statements including income statement and statement of cash flows to conduct fundamental analysis or calculating financial ratios.

Basically, every business needs a balance sheet to apply for loan or grants, seeking potential investors and understanding of the business financial position. A balance sheet may seem a little intimidating to those having little understanding of accounting practices.

Yet, small business owners, with fewer entries to fill up, will have an easier time having their balance sheet interpreted.

-

Bank Reconciliation Statement

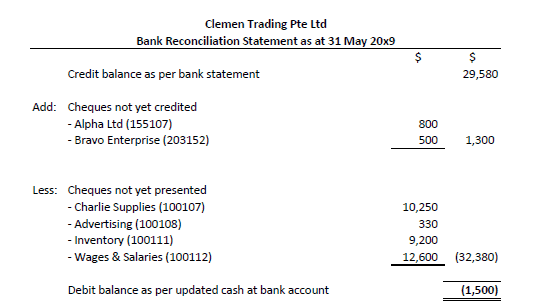

This refers to a monthly document that helps to check the cash at bank balance of the business against the bank’s record as shown on the bank statement.

Primarily, by doing so, it enables the business to explain the discrepancies between the cash at bank account balance and the monthly bank statement balance. All businesses prepare Bank Reconciliation Statement monthly as it also helps in detecting any potential errors or fraud committed.

-

Trial Balance

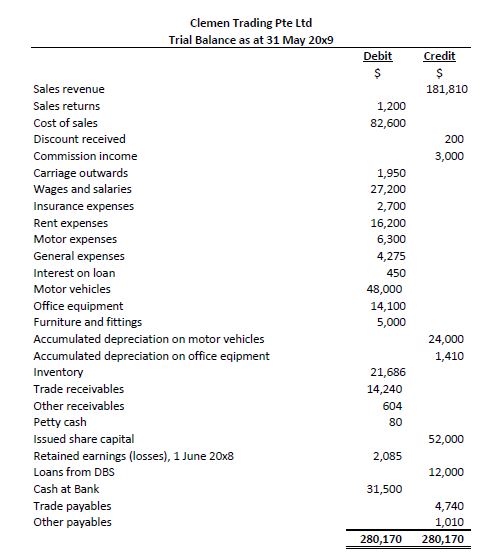

A Trial Balance refers to a list of all the general ledger accounts contained in the ledger of a business. All of these are compiled into debit and credit accounts column totals that are equal.

The general purposes are to ensure that all entries in the company’s bookkeeping system are mathematically correct and to assist in the preparation of financial statements such as the Income Statement and Balance Sheet.

-

Control Account

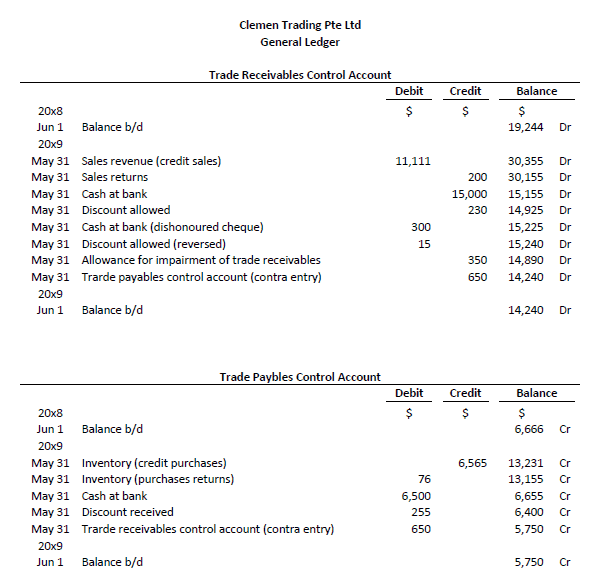

A Control Account refers to a summary account in General Ledger. Details for each control account are recorded in a separate subsidiary ledger (Sales Ledger and Purchases Ledger). While a control account is kept clean from details, it contains the correct balances to be used in the accounting statements.

In the practical world, the management of a control account varies between businesses. Small business owners keep the individual trade receivables and payables accounts in a single accounting general ledger, a trial balance can be extracted from that ledger. There is no necessity to prepare control accounts.

It is a very different situation for a larger business. To ease the management of tedious ledger accounts, subsidiary ledgers (Sales and Purchase ledgers) will be opened to keep track of the detailed debts owed by the trade debtors and debts owed to the trade creditors respectively.

Control accounts are maintained in the general ledger for each of the subsidiary ledgers, representing the total debts due by the trade debtors and due to the trade creditors.

The Account Receivables Aging Report (prepared by commercial businesses) is based on the information extracted from the Sales Ledger, where transactions by individual trade debtors are kept. The total debts reported will tally with the Trade Receivables Control account.

To have a profound understanding of how a control account works, the understanding of the Journals topic is crucial.

Conclusion

With that, we have tried to put into perspective how the above-mentioned accounting statements apply to commercial businesses. We hope that this article has broadened your understanding of POA and allow you to appreciate the learning in relation to the real application. This will make learning POA meaningful.

Our Best POA tutor, Mr Edmund Ling has extensive real-life experience as an accountant beside his 30-year experience in delivering Stellar POA Tuition. We believe that his experience will help students achieve the distinction they are looking for. For more enquiries, please feel free to contact us.